The Central Board of Indirect Taxes and Customs (CBIC) has released a major government recruitment announcement for 2025.

The application window for Tax Assistant and Havildar positions became available on August 23rd 2025. The following article provides a detailed overview of the Income Tax Recruitment 2025 process.

Income Tax Assistant Recruitment 2025

The Central Board of Indirect Taxes and Customs (CBIC) has issued a recruitment announcement. The recruitment process includes two positions which are Tax Assistant and Havildar and accepts applications from both male and female candidates.

| Organization Name | Central Board of Indirect Taxes and Customs |

| Post Names | Tax Assistant, Havildar |

| Total Posts | Multiple |

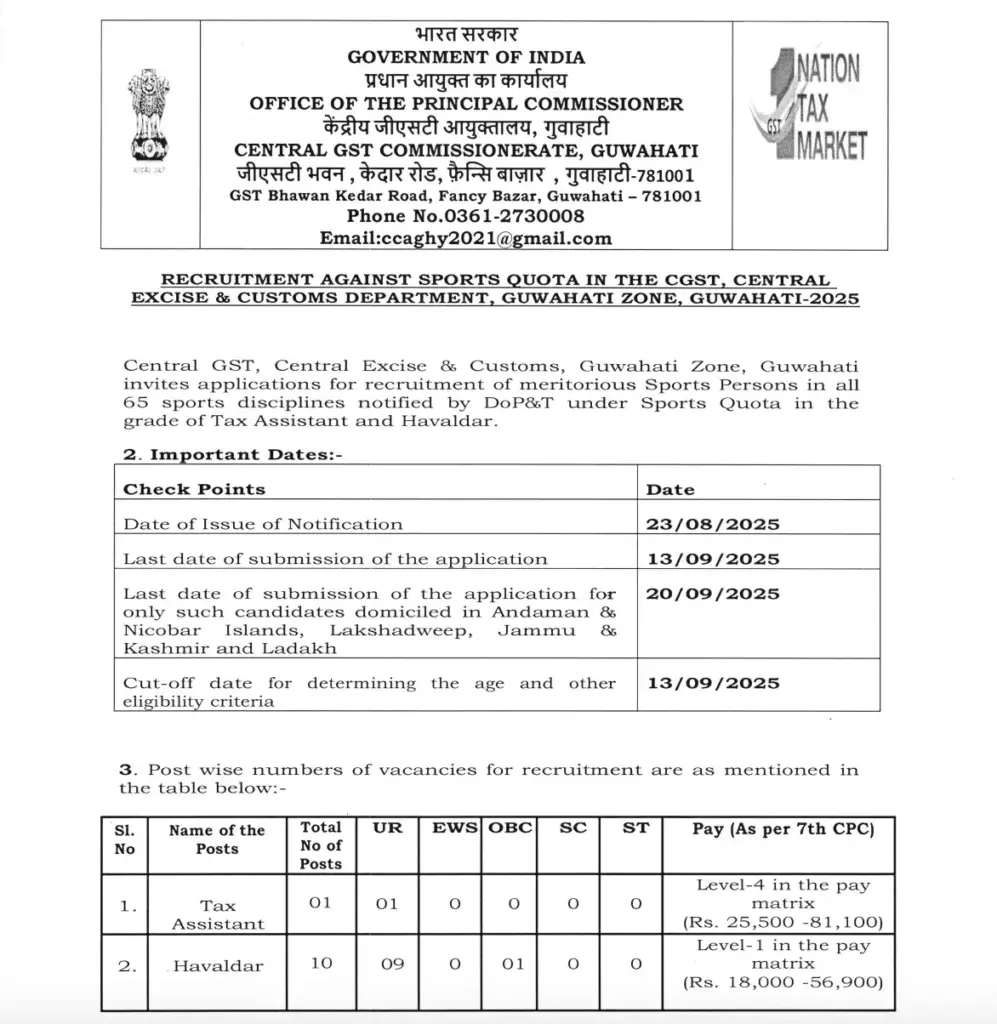

| Application Start Date | 23 August 2025 |

| Last Date | 13 September 2025 |

| Last Date for Form Submission | 20 September 2025 |

| Application Type | Offline Only |

| Eligibility | 10th Pass, Graduate |

| Selection Process | Skill Test + Physical Test |

| Official Website | https://www.cbic.gov.in |

The recruitment process operates through offline methods while eliminating written examination requirements. The recruitment process will evaluate candidates through skill tests and physical assessments.

Read this also: Grameen Bank Office Assistant Recruitment

Types of Vacancy

The recruitment process includes two primary positions which the department has announced.

- Tax Assistant

- Havaldar

Eligibility Criteria

The Tax Assistant position requires applicants to hold a university degree from an accredited institution. The candidate needs to demonstrate basic computer skills and achieve 8000 key-depressions per hour in data entry operations.

The application process for Havaldar position accepts only candidates who finished their 10th class education.

Documents Required

You need to prepare these necessary documents before starting your application.

The application requires two types of documents: passport size photographs and signature.

- Aadhar card

- Mobile number and email ID

- 10th/12th mark sheet

- Graduation certificate (for Tax Assistant post)

- Caste certificate (SC/ST/OBC)

- Birth certificate or 10th mark sheet serves as proof of age.

- Disability certificate (if applicable)

Age Limit

- Minimum Age: 18 years

- Maximum Age: 27 years

Age Relaxation:

The recruitment offers a 5-year age relaxation benefit to OBC candidates.

The recruitment offers 10 years of age relaxation to candidates who belong to SC/ST categories.

Application Fee

The recruitment announcement states that there are no fees required for application submission.

Selection Process

The CBIC selection process includes three evaluation stages.

1. Skill Test/Physical Test:

- Tax Assistant: The computer proficiency test includes a typing assessment.

- Havildar candidates must pass a Physical Standard Test which includes running and other physical challenges.

2. Document Verification

3. Medical Exam

The recruitment process does not include any written assessment.

How to Apply Income Tax Assistant Recruitment?

Step 1: Visit the official website

The application process requires candidates to submit their forms through offline channels. The official website https://www.cbic.gov.in provides access to download the application form.

Step 2: Fill the offline form

The notification contains an application form which you should print out for completion.

Enter your full name and parental information and residential address and contact details and email address and academic background accurately in the application form.

Choose between Tax Assistant and Havildar positions when you apply for this role.

Step 3: Attach Documents

Paste passport size photo.

You must include photocopies of your educational documents and Aadhaar card and caste certificate (if needed) and age verification document.

Step 4: Submit Application Form

After completing all required information and document attachments you need to mail the application form to the address specified in the notification.

Make sure to submit your application before the deadline to prevent your application from being rejected.

Important Date

| Application Start | 23 August 2025 |

| Last Date | 13 September 2025 |

Food Department Recruitment FAQ

The Central Board of Indirect Taxes and Customs (CBIC) conducts this recruitment process.

The recruitment process includes multiple positions although the exact number of available positions remains undisclosed.

The recruitment requires Tax Assistant candidates to hold a graduate degree while Havildar applicants need to have completed their 10th grade.

The recruitment process will not include any written examination. The selection process for this recruitment will use Skill Test/Physical Test instead of written exams.

The application fee amounts to zero rupees (₹0) for all candidates.

Important Links

| Official Notification | Download PDF |

| More Govt Jobs | Latest Job Updates |

| Apply Link | Click Here |

Final Thoughts

The following post contains complete details about CBIC Income Tax Recruitment 2025. The recruitment offers government positions to candidates who possess 10th-grade or graduate degrees without requiring any examination.